tax strategies for high income earners australia

However this is not the full story. For single filers if your 2021 taxable income was 40400 or less or 80800 or less for married couples filing jointly then you wont owe any income tax on dividends earned.

Expats In Australia Expat Tax Professionals

There are no CGT consequences for switching between underlying investment strategies within an investment bond.

. This is the rate that will apply to each additional dollar that you earn until you earn so much that you graduate to the next bracket. A tax bracket refers to the highest marginal tax rate that you pay on any part of your taxable income. As an example if your gross income is 80000 and you have 20000 in various tax deductions you can use them to reduce your taxable income to 60000.

In the UK when you look at income tax bands it appears that way. The number of words in the Federal Tax Code. The Bible has about 700000 words.

Pay Attention to the Medicare Surtax and Net Investment Income Tax for High Earners There are two types of Medicare tax that could be affected by your income level. YEAR-END TAX ADVICE 6. To find out more about government co-contributions and to.

Low and middle-income earners who make after-tax super contributions may also be eligible to receive a co-contribution from the government up to a maximum amount of 500. The federal income tax is designed to tax higher levels of income at higher tax rates. 10 There are several types of taxes.

Investment earnings are taxed at the corporate tax rate of 30 by the issuer meaning earnings are not required to be included in an investors assessable income tax return unless withdrawn prior to the 10 year period. Urine at that time was collected and used as a source of ammonia for tanning hides and laundering garments. A tax deduction and tax credit are two.

For example lower earners pay no tax then the rate starts at 20 growing to 40 for higher rate taxpayers. For each pound that a contractor earns over 150000 the marginal rate becomes 45 so higher earners pay more tax. 7 The number of words in Atlas Shrugged is 645000.

Roman emperor Vespasian placed a tax on urine in the 1st century AD.

Proposed Tax Changes For High Income Individuals Ey Us

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Some Of Australia S Highest Earners Pay No Tax And It Costs Them A Fortune Greg Jericho The Guardian

101 Ways To Save Money On Your Tax Legally 2020 2021 Wiley

14 Tax Tips For The Self Employed Taxact Blog

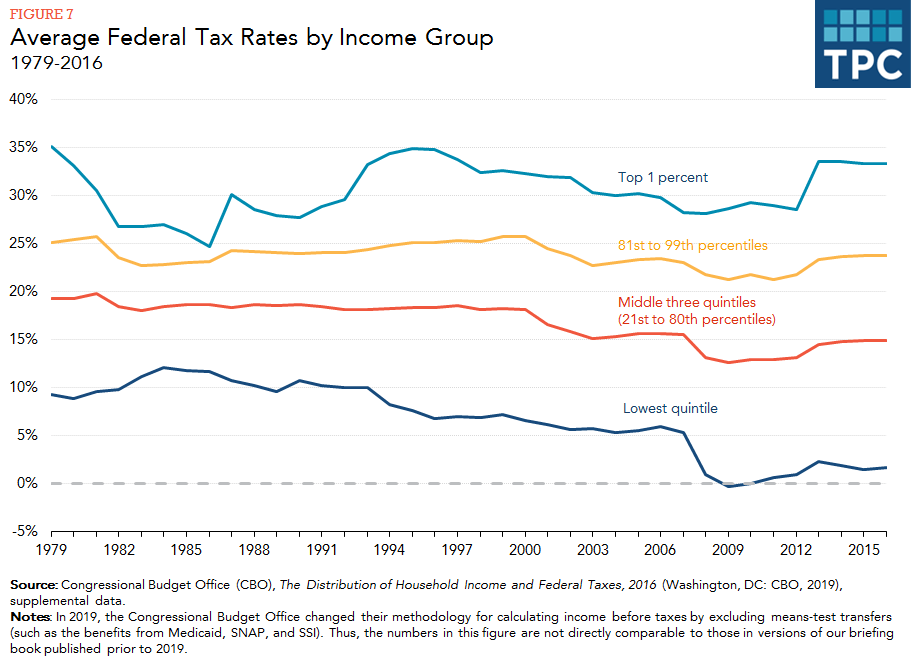

How Do Taxes Affect Income Inequality Tax Policy Center

10 Surefire Tax Tips For Year End 2021

How Do Taxes Affect Income Inequality Tax Policy Center

10 Easy Ways To Reduce Tax More Tips From The Etax Experts

:max_bytes(150000):strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

If You Re A Younger Worker In Australia Don T Be Fooled On Tax Cuts Greg Jericho The Guardian

Biden S Tax Plan Know The Basics For Your Client Conversations On Tax Blackrock

Australia Reaches Across Borders To Shore Up Post Pandemic Recovery Australian Institute Of International Affairs Australian Institute Of International Affairs

2020 S Top 10 Individual Tax Planning Strategies Cohen Company

:strip_icc()/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

How Do Taxes Affect Income Inequality Tax Policy Center

Shipping Container Homes Halifax Shipping Container Homes Container House Plans Container Homes For Sale